In times of emergency, short-term loans come in handy, and Cash App is one platform that can assist borrowers.

It is important to note that the Cash App may not be available in many locations and is not yet fully functional. In addition, the application provides no information on short-term loans on its website for the purpose of transparency and accountability.

Therefore, there are relatively few people who are familiar with how to borrow money through the Cash App. For information regarding the Cash App loan process and the people eligible for its loans, borrowers may consult reputable websites and forums such as Reddit. In addition to being time-consuming and confusing, this can be very time-consuming.

For your convenience, we have provided all the information you need to know about borrowing money from the Cash App and its other features.

Table of Contents

How Much Does A Cash App Loan Cost?

For a better understanding of Cash App loans, it is necessary to discuss their costs. In general, short-term loans are not inexpensive. In response to the fact that brands are aware that personal loans and payday loans help people solve their problems quickly, particularly those with poor credit histories, higher interest rates are charged.

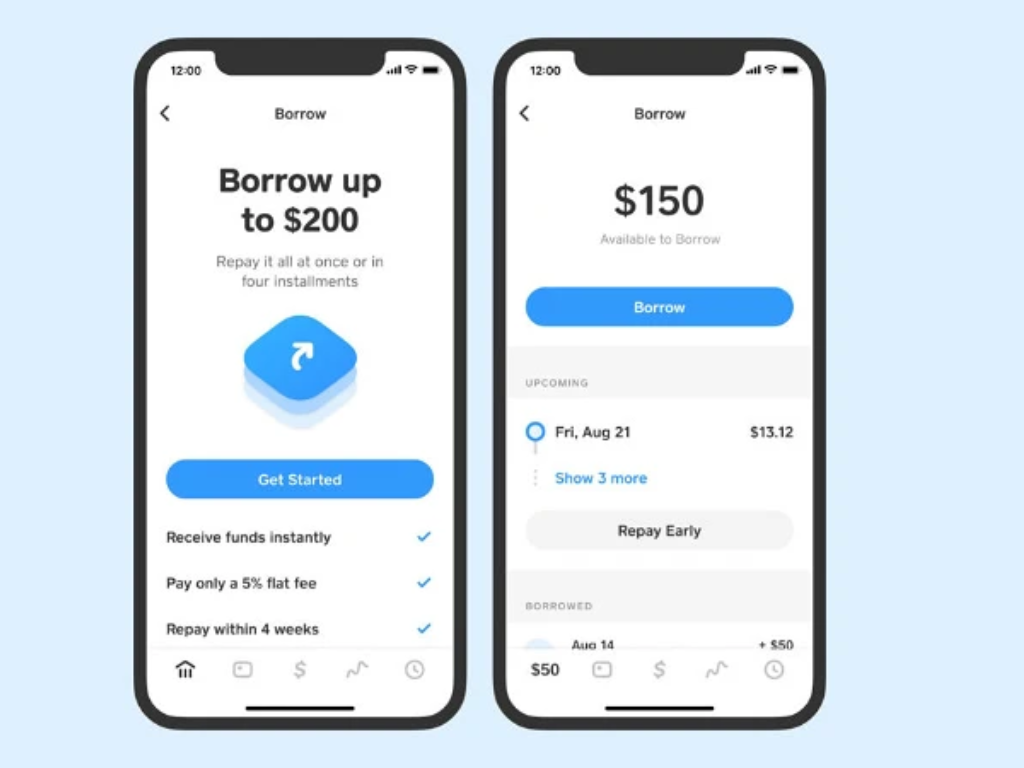

There is a 5% interest rate attached to Cash App Borrow a loan. In order to borrow money from the platform, you must repay the loan within four weeks of borrowing it.

Upon expiration of the deadline, you will have a one-week grace period before you begin paying additional interest of 1.25% per week. However, this is only applicable if you fail to comply with the deadline or grace period.

In addition to the benefits discussed above, borrowing money from Cash App is much more affordable than borrowing money from a payday loan or personal loan. With the app, you are able to handle any emergency before your next payday in a quick and efficient manner. The Cash App is limited to $200, and borrowers with existing loans are not eligible for a second loan.

It may be necessary for you to use another cash advance app if you need to borrow more than $200.

Additionally, if you need a personal loan that can solve a serious problem, there are several payday loan brands available on the Internet that can come to your rescue.

How To Borrow Money From Cash App Borrow

A short-term loan from Cash App Borrow may only be obtained by eligible borrowers.

- Install the Cash app on your mobile device

- You may then check the balance of your account

- Upon completing the process, you will be directed to the banking section of the website.

- The “Borrow icon” will have a blue arrow sign if you have access to receiving money from the Cash App.

- Click “Unlock” next.

- In the app, you will be informed of the amount you can borrow based on the number of deposits you have made.

- It is important that you read and accept the Borrow Loan Agreement prior to applying for a loan.

The following is a detailed explanation of how you can apply for a loan with this app online.

Step 1: Select Cash App to Borrow Cash

When you open the Cash App on your device, you will be able to borrow money. It is important to remember that only eligible borrowers are eligible to do so.

Step 2: Fill out the Short-Term Loan Application

In the next step, you will need to complete the application form. It is important that you do not rush through this process and that you do not enter fraudulent information. To use the app, you must enter only valid information such as your full name, your employer’s name, your bank account information, and the state in which you reside.

Fill out the application correctly to ensure you can borrow money from Cash App without difficulty.

Step 3: Await the Loan Agreement

In order to be matched with cash advance apps or loan providers, it would be best to wait for a few minutes. If your loan request is approved, the lender will send you a loan agreement detailing your borrowing limit, late payments, monthly payments, and Cash App borrowing capabilities.

Thus, it is important that you carefully review the conditions, interest rates, and terms associated with short-term loans.

Step 4: Sign the Loan Contract

A Cash App user must sign a loan contract before borrowing money. After your loan request has been approved, a direct deposit will be made to your bank account.

How To Unlock Cash App Borrow

As we mentioned earlier, not all individuals are eligible to use Cash App Borrow. It is necessary for you to have a Cash App account and make deposits in order to qualify for a loan through the app. Cash App requires direct deposits into their accounts.

In order to establish trust with the brand, you must make regular deposits to unlock Cash App Borrow. As an example, you may be eligible for the Cash App loan if you make at least $1,000 a month in deposits.

Can You Borrow Small Loans From Cash App?

Our limited financial resources sometimes prevent us from sending money to loved ones. Due to the fact that emergencies have no specific date or time, you are not likely to have the resources to manage such a situation financially.

As a result, you may need to borrow money from personal loan companies or other cash advance apps. Using the Cash App Borrow platform, you can request loans as low as $20.

You can use the app to save money and manage your resources with low-interest rates. If you apply for a loan through Cash App, for example, you will not be required to pay a high-interest rate. In exchange for a $200 loan, the app demands that you repay the loan with an interest rate of $10.

It is important to note, however, that not everyone in the United States may borrow money from Cash. There are a few requirements that must be met for you to be eligible for these small loans. We have listed how you can check your eligibility for these small loans.

The following factors may prevent you from obtaining a cash advance:

- Credit history: Before offering you a loan, the brand will take into account the history of your credit score. A credit check gives you greater leverage when requesting loans, particularly if you require urgent approval.

- State of residence: The Cash App Borrow is not available to all United States residents. According to TechCrunch, only one thousand users were tested with the Borrow feature. There has been no comment from Cash App regarding this limited number of users.

- Cash App use: Compared to other borrowers, active cash app users have greater access to loans.

- Cash Card usage: Customers who possess Cash Card debit cards are given priority when applying for loans.

- Direct deposits: In order to qualify for a Cash App loan, you must regularly deposit funds into your account. Moreover, you must link your bank account to the app in order to conduct financial transactions.

MoneyMutual is one of the largest online lending networks in the United States, and many do not require a credit check. When you have been approved for a short-term loan, you will be able to complete all the paperwork online and have the money deposited into your bank account the following business day. As part of this program, consumers can be connected with quality short-term lenders who offer services including payday loans, instalment loans, and loans for people with bad credit.

How Does Cash App Function?

A peer-to-peer application available on Google Playstore and Apple Store, Cash App works as a peer-to-peer payment system. Using the app, you can send money to loved ones via your mobile device. This app was developed by Square, now known as Block, to facilitate the payment process for consumers.

Cash App initially worked as a payment option similar to Paypal, Zelle, or Venmo, allowing users to make payments. Furthermore, the Cash App Taxes service allows you to file your taxes using Bitcoin and the app.

By providing the app, the underbanked and unbanked communities are able to conduct financial transactions. People with bad credit may benefit from the short-term loans offered by this financial institution in an emergency. Loan applications can be submitted using the app by individuals whose credit reports do not exceed 600.

If you borrow money in Cash, you will have four weeks to repay the loan. This is different from payday loans or personal loans. Moreover, if you default after your one-week grace period, you will be charged 1.25% more in addition to the 5% fee.

Therefore, the Cash App Borrow translates into an annual APR of 60%, which represents a very good deal. It is important to note, however, that the app borrow may offer you a higher average interest rate than what you would receive from a personal loan.

Wrapping Up

With Cash App, you will not be charged excessive interest fees if you wish to borrow money. For a $200 loan, you may pay no more than $10 if you qualify for the loan. Although this app is available in the United States, not all citizens have access to it.

As compared to personal or payday loans, Cash App offers one of the most affordable loans online. In addition, before signing the loan agreement, it is important that you read the terms of the loan.